Asia releases blockchain based currency in 2020 according to Outrageous Predictions. Saxo Bank, the leading Fintech specialist focused on multi-asset trading and investment, has today released its 10 ‘Outrageous Predictions’ for 2019. The predictions focus on a series of unlikely but underappreciated events which, if they were to occur, could send shockwaves across financial markets.

While these predictions do not constitute Saxo’s official market forecasts for 2019, they represent a warning of a potential misallocation of risk among investors who typically see just a one percent likelihood to these events materialising. We do not endorse or suggest any predictions as being true.

You can vote for any prediction becoming reality or not here.

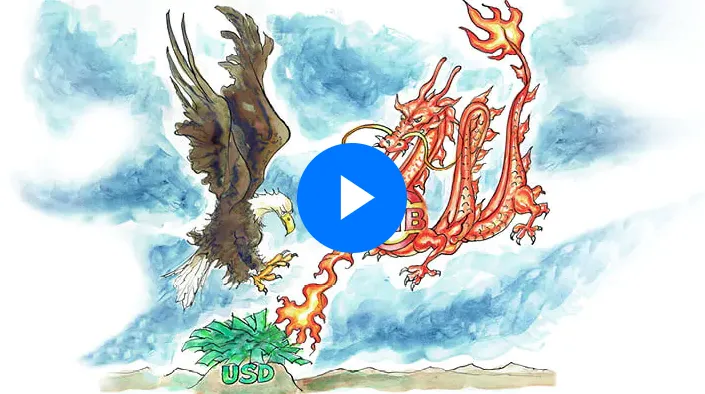

An Asian, AIIB-backed digital reserve currency takes the US dollar index down by 20% and tanks the US dollar 30% versus gold.KAY VAN-PETERSEN

GLOBAL MACRO STRATEGIST

The US dollar as the world’s chief reserve currency has always been a two-edged sword, both for the US, and for a rising China — which has done well by funding itself in US dollars, absorbing global capital to drive the greatest growth in a single nation’s economy the world has ever seen.

But the USD as reserve currency is outliving its usefulness for the region. To confront a deepening trade rivalry and vulnerabilities from rising US threats to weaponise the US dollar and its control of global finances, the Asian Infrastructure Investment Bank creates a new reserve asset called the Asian Drawing Right, or ADR, with 1 ADR equivalent to 2 US dollars, making the ADR the world’s largest currency unit.

The ADR is driven by blockchain technology and regional central bank reserves are powered up with quantities of this reserve currency — equivalent to a combination of existing gold reserves, current non-US dollar FX reserves, GDP size and trade volumes. As a reserve asset, the ADR is not tradeable by the general public, but represents a basket of currencies and gold, with the Chinese renminbi heavily prominent in the mix and the US dollar weighted at below 20%.

The move is clearly aimed at de-dollarising regional trade and local economies multilaterally agree to begin conducting all trade in the region in ADRs only, with major oil exporters Russia and the OPEC nations happy to sign up on their growing reliance on the Asian market. Blockchain technology ensures stability of the money supply and tracking of transactions in the currency. Export revenues received in ADR can be converted back into local currencies by central banks and a deepening market of ADR-based bonds and other financial instruments, also secured on the blockchain, deepens the liquidity and trust in ADRs as a reliable asset.

The redenomination of a sizable chunk of global trade away from the US dollar leaves the US ever shorter of the inflows needed to fund its twin deficits. The USD weakens 20% versus the ADR within months and 30% against gold, taking spot gold well beyond USD 2000 per ounce in 2020.

Continuing almost two decades of tradition, our experts have made 10 Outrageous Predictions for the year ahead. Their consensus-smashing forecasts would send shockwaves through the markets, if they come to pass. So will they prove pure fantasy or visions of reality?