In a startling turn of events, BharatPe, one of India's leading fintech companies, finds itself mired in compliance trouble yet again. Reports have surfaced that the company is blocking merchant settlements and mandating a re-submission of documentation for Know Your Customer (KYC) verification. This development has sent shockwaves through the Indian fintech industry, raising questions about the company's compliance procedures and the implications for its vast network of merchants.

Bharatpe's Compliance Woes:

Bharatpe, founded in 2018, has gained significant prominence in the Indian digital payment ecosystem. The company's mobile application offers a comprehensive suite of financial services, from digital payments and bill payments to lending and credit services, primarily targeting small and medium-sized businesses (SMBs). However, the firm's growth trajectory has been marred by various regulatory challenges and compliance issues in the past.

The most recent setback comes as Bharatpe temporarily suspends merchant settlements. This has reportedly left thousands of merchants across the country grappling with financial disruptions. The firm's decision to revisit the KYC documentation appears to be the root cause of the problem.

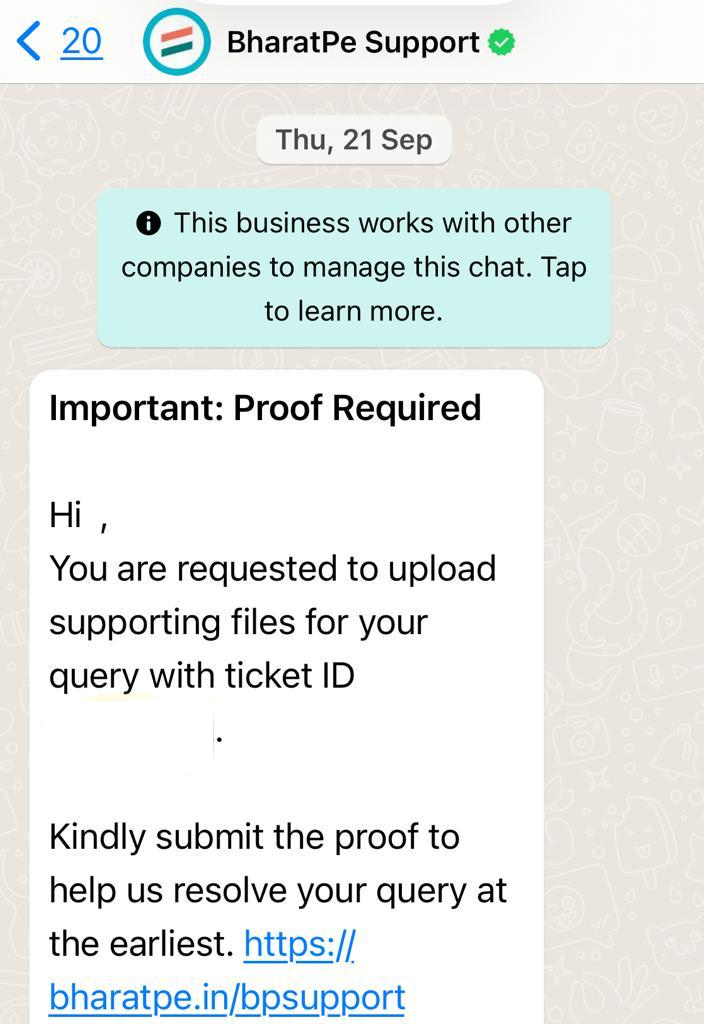

BharatePe KYC Reverification Process:

Bharatpe's KYC process is a crucial component of its operations, ensuring the integrity and legality of transactions on its platform. It involves collecting and verifying merchants' personal and business details, which is a standard practice in the financial industry.

However, sources have informed WePlayCoins that the re-verification process is not voluntary, but rather mandatory for all registered merchants on the Bharatpe platform. This has raised concerns about the nature and extent of the compliance issues faced by the company, potentially pointing to deeper problems within its regulatory framework.

Impact on BharatPe Merchants:

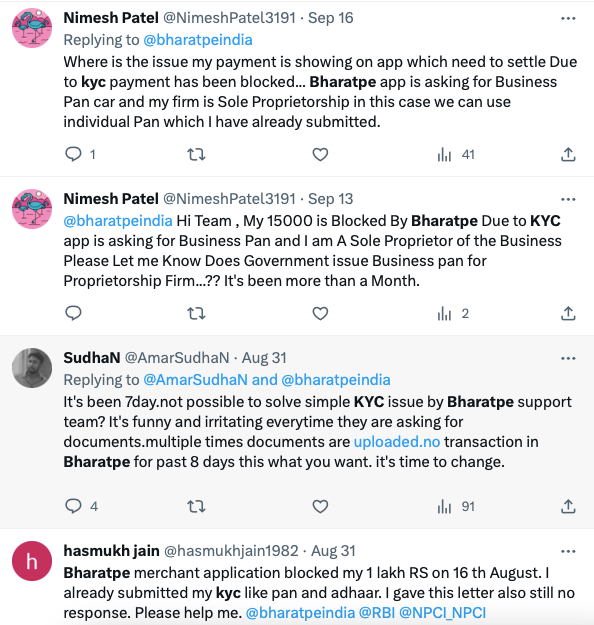

Merchants, who rely heavily on Bharatpe for payment processing and other financial services, are undoubtedly the most affected by this development. With their settlements put on hold, many are struggling to manage their day-to-day operations and meet their financial obligations. The sudden disruption has left them with financial uncertainty and frustration, as they await resolution from Bharatpe.

Merchants have been complaining on X (formerly known as Twitter) that their settlements have been blocked for months and are struggling to get their moeny back.

Regulatory Scrutiny:

The compliance issues at Bharatpe have also piqued the interest of regulatory bodies in India in the past. The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) have a history of keeping a close eye on fintech companies to ensure adherence to financial regulations and protect consumer interests. Given Bharatpe's extensive reach and influence in the industry, this situation could trigger a closer examination of its operations.

The Way Forward:

The ongoing crisis at Bharatpe underscores the importance of robust and reliable compliance measures in the fintech sector. As India's digital payments and fintech ecosystem continue to grow, ensuring the security and reliability of these services is paramount.

For Bharatpe, the challenge is not only to expedite the KYC re-verification process but also to rebuild the trust of its vast merchant base. The company must also work closely with regulatory authorities to address any underlying issues and prevent future compliance hurdles.

In conclusion, Bharatpe's compliance troubles and the subsequent suspension of merchant settlements have sent shockwaves through India's fintech landscape. The coming weeks will be crucial in determining the extent of the issue and the steps taken by the company to regain its standing in the market. As regulatory scrutiny intensifies, the fintech sector will be watching closely to see how this situation unfolds and what it means for the industry at large.