Binance crypto review of 2019 has been released on the company blog. The exchange has put up the complete datasheet on their site. There is a detailed breakdown of the different types of cryptocurrencies and how they performed in 2019.

- BNB was the best-performing asset (+128%) of the – on median – largest ten cryptoassets by market capitalisation over 2019. Bitcoin was the second best-performing asset (+87%) in this group.

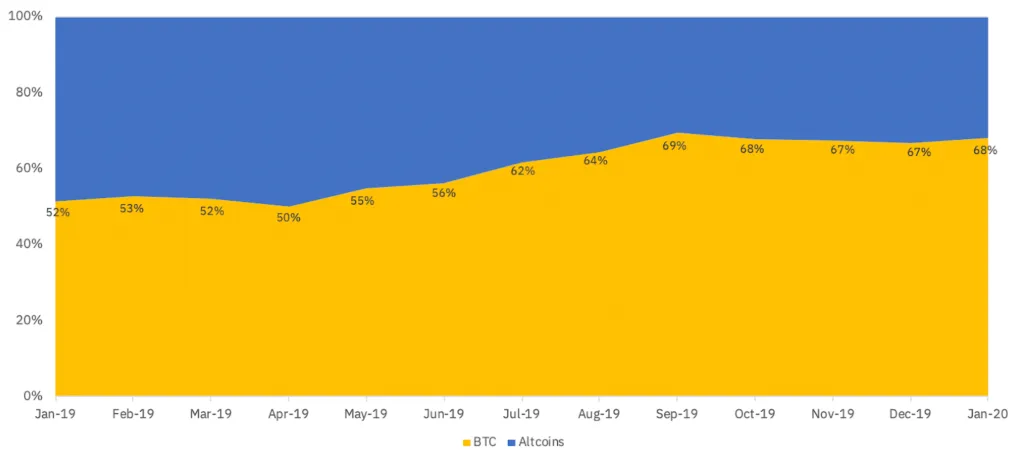

- Bitcoin’s market dominance seemingly stabilized around 68% after a strong climb from ~ 50% at the beginning of this year.

- Generally, cryptoassets continue to be highly correlated with each other, exhibiting high median correlation coefficients.

- Ether (ETH) is the highest correlated asset. With an average correlation coefficient of 0.69 throughout 2019, it is consistently among the most correlated assets. The coefficient started at 0.69 in Q1 and rose to 0.72 in Q4 (Q2: 0.65; Q3: 0.74).

- The lowest correlated asset, Cosmos (ATOM), has a median annual correlation coefficient of 0.31, followed by Chainlink (LINK) and Tezos (XTZ) with coefficients of 0.32, respectively, 0.4.

- Other than that, general clusters can be identified: programmable blockchains such as EOS, NEO, and Ethereum, for example, show higher median correlations with each other than alternative assets.

- Lastly, assets might be stronger correlated with each other in adverse price movements. A further analysis over a more extended period could substantiate this finding.

Additionally, in a similar fashion to the previous reports, several general factors are found that likely influence the strengths of relationships between cryptoassets. These and other specific relationships are listed below:

- Besides Ethereum (ETH), Bitcoin (BTC) was strongest correlated with Bitcoin Cash (BCH) and Monero (XMR), two other PoW cryptoassets.

- Programmable blockchains (e.g., NEO, Ethereum, EOS) often exhibited higher correlations with each other than with non-programmable assets. This trend continued in the same way as in previous quarters.

- “Binance Effect”: assets listed on Binance displayed higher correlations than with the cryptoassets not listed on Binance.

- After Cosmos (ATOM), Huobi Token (HT) had – on median – the lowest correlation with other cryptoassets.

The median correlation between most large cryptoassets slightly declined over the fourth quarter of 2019. This trend upholds the annual median correlation, which is lower than in Q3 or Q4. Nonetheless, cryptoassets remained highly correlated with each other in 2019.In line with our previous reports, idiosyncratic factors such as programmable blockchains and the existence of a potential “Binance Effect” remain some of the critical factors impacting the strength of correlations among cryptoassets. Additionally, Ethereum became the most relevant benchmark of the crypto-market in 2019, displaying the highest median correlation with all other cryptoassets.Further research could assess whether median correlations among cryptoassets are affected by the current market price movement. This first evidence indicates that cryptoassets might be stronger correlated with each other in market movements negatively affecting the price of cryptoassets. Binance crypto review of 2019 shows how cryptocurrencies are growing in popularity and are getting more mainstream support. The full report is available on the website here.