A new real-time index tracking the total electricity consumption of the Bitcoin network was launched by the Cambridge Centre for Alternative Finance. The Cambridge Centre for Alternative Finance (CCAF), an academic research centre at Cambridge Judge Business School, University of Cambridge, launched the CBECI on 2nd July 2019.

The index has been named the Cambridge Bitcoin Electricity Consumption Index (CBECI) and it hosts a website that provides a real-time estimate of the total annual electricity usage of the Bitcoin network. It also allows one to perform comparisons with other electricity consumption scenarios as a measure of the amount of power the Bitcoin network consumes.

Why does Bitcoin consume power?

The Bitcoin Protocol has a built-in check that makes sure that it cannot be tampered. Called the Proof of Work (PoW) consensus algorithm, it is a technique to stop unwanted access to the software by making sure that a short computational problem be solved to prove an authentic action. To complete this calculation required to solve the mathematical problem a certain amount of computer power is used. The computation must be done on a CPU/GPU which pulls in electricity to complete the task. This is usually a very inconsequential amount of power. However, when that number increases to a large network spread across the world, it has real world consequences.

Bitcoin is the most popular cryptocurrency in the market. There are others built around the same system. The more people get involved in the Network, the higher the computation increases. This is to do with cryptocurrency mining.

Mining cryptocurrency is not a physical activity or any conversion of ore to finished products. In order to keep track of the transactions, the Bitcoin protocol introduced the, now very popular, block mechanism. In short, instead of storing all the transactions in one place like a company server, the transactions are stored in “blocks”. Each block is added to the publicly available “chain”. But to be added they must complete the Proof of Work computation. When they complete it, the transaction is registered in the blockchain and the “miner” gets a percentage of Bitcoin as a reward. The more people who try to “mine”, the more complex the mathematical computations will become. This requires more power and so on and so forth.

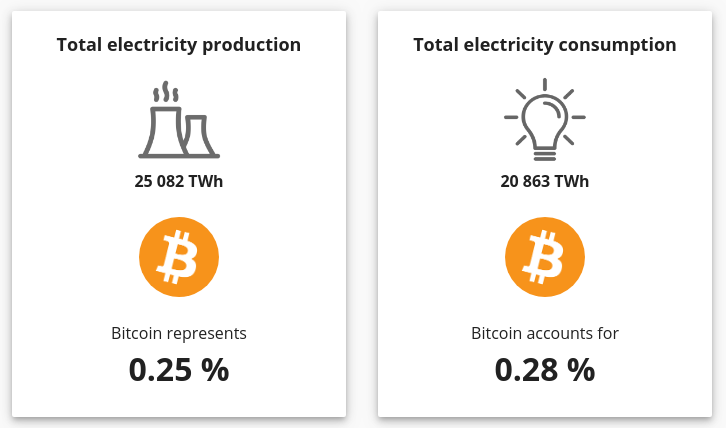

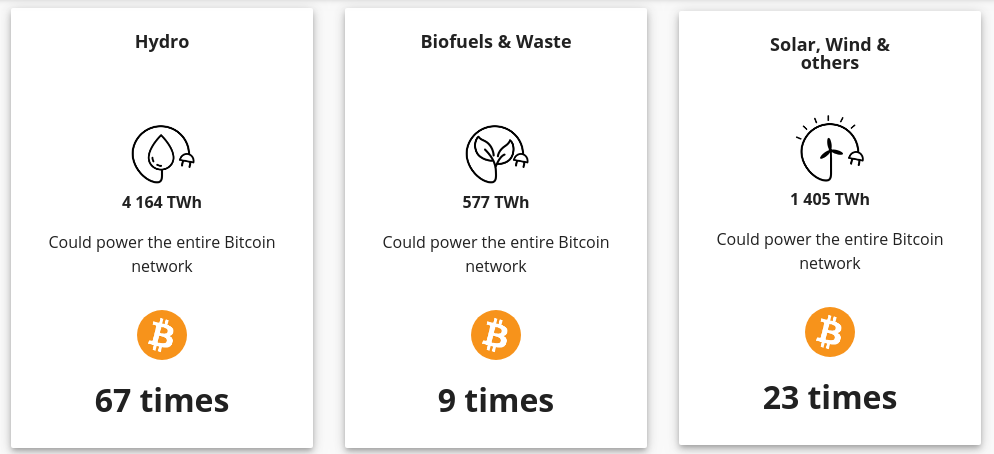

The index provides an interesting take on the impact of the “virtual” currency on the infrastructure. Being peer-to-peer, this was hard to estimate. The comparison page provides the best glimpses of the impact of cryptocurrencies.

The current consumption is 8.12 GW with an estimated annual consumption of 61.88 TWh. This is comparable to the annual consumption of Switzerland (58 TWh) and Austria (64 TWh). The bitcoin network seems to be consuming enough electricity to power a small european nation and is slated to grow in the future!

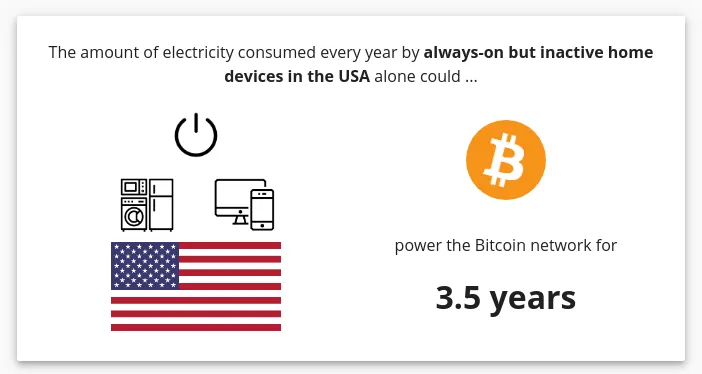

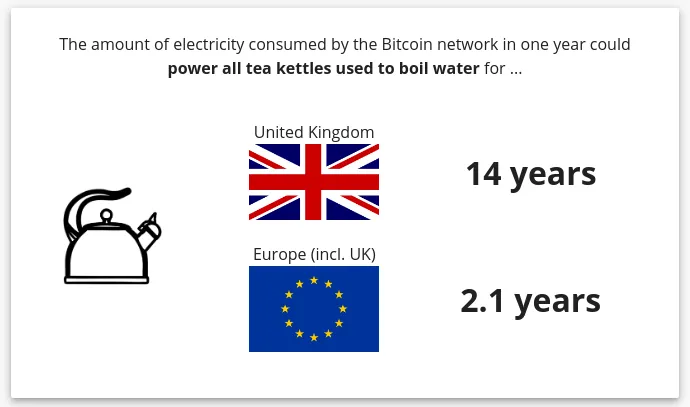

Other fun facts of comparison are –

1 year of USA’s unused but plugged in appliances could power Bitcoin for 3.5 years

Bitcoin could heat British people’s tea for 14 years with one years power consumption.

Bitcoins power consumption of one year could power the Cambridge institute for 352 years!

While it suggests that Bitcoin is consuming “too much” power, we must realize that this is the consumption all over the world. Further, the mining with end in a few years reducing the amount of power that the crypto consumes. This website merely provides perspectives on the capacity of a fully decentralized concept to take over the world.