Cryptocurrencies to be banned in Apple Card according to an article by The Verge. Users cannot use the services on Jailbroken phones as well.

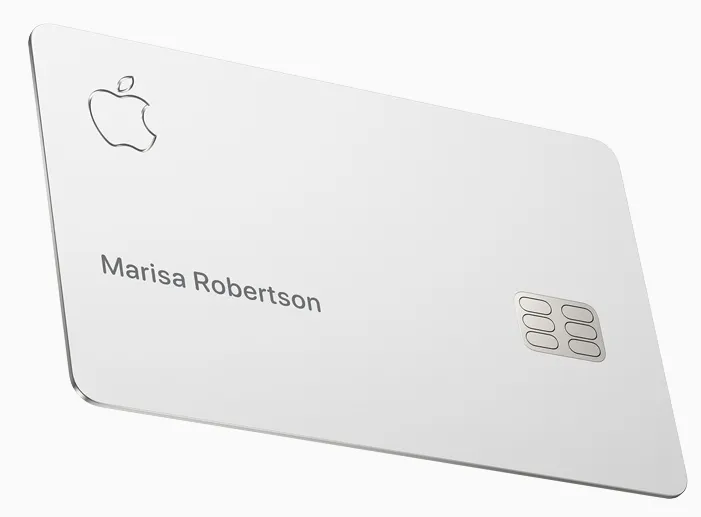

Apple will be introducing a new Credit Card like payment system called Apple Card in the coming days. The team behind the service has made a public statement that users who jailbreak their apple products or use it to purchase or trade in Cryptocurrencies may lose access to their accounts.

Apple Card and Cryptocurrencies

Goldman Sachs, the creditor behind the Apple Card has released the customers terms and agreements document which outlines the ban on cryptocurrencies along with other entities.

In their defence, this is a standard practice of applying the existing laws on Cash Equivalents. Cash Equivalents are entities that are not cash but act like it under certain circumstances. For example, Poker Chips would be Cash Equivalents, and you cannot buy Poker Chips with a credit card. The same rule applies for cryptocurrencies which fall under the heading of Cash Equivalents.

According to the document –

“Cash Advance and Cash Equivalents” means any cash advance and other cash-like transaction, including purchases of cash equivalents such as travelers checks, foreign currency, or cryptocurrency; money orders; peer to peer transfers, wire transfers or similar cash-like transactions; lottery tickets, casino gaming chips (whether physical or digital), or race track wagers or similar betting transactions.

Apple Card and Jailbroken iPhone

You will need an Apple Wallet and Apple device to apply for the Apple Card. Once your application is accepted and your card processed, you need an iPhone to connect to your account. If your “eligible” device has any unauthorized hardware or software changes, your account could be suspended. Rather than being harsh on Apple and Goldman Sachs, we can appreciate the steps taken by them. These are security features to help protect users against possible breaches.

The document outlines it as follows –

At the time your Account is created, a digital Card will automatically be added to your Apple Wallet on the Required Device that you used to apply for an Account. You can use Cards to make Transactions on your Account. You can add a Card to your Eligible Devices, but you must maintain a Required Device with a digital Card to manage your Account electronically. Without a Required Device, you will only be able to manage your Account by contacting us by phone or mail, and your Monthly Statement will only be sent to you by email or mail. If you do not maintain a Required Device, we may close your account.If you make unauthorized modifications to your Eligible Device, such as by disabling hardware or software controls (for example, through a process sometimes referred to as “”), your Eligible Device may no longer be eligible to access or manage your Account. You jailbreaking acknowledge that use of a modified Eligible Device in connection with your Account is expressly prohibited, constitutes a violation of this Agreement, and could result in our denying or limiting your access to or closing your Account as well as any other remedies available to us under this Agreement.

As the Verge put it –

So if you were hoping the Apple Card might be a bold new form of credit that would let you make purchases that, say, Chase would not, this may be a bit of bad news. For everyone else, it doesn’t seem likely to have a big impact on how desirable the product is. After all, the Apple Card’s biggest draw will likely be as a status symbol for iPhone owners.

Read the full document here.