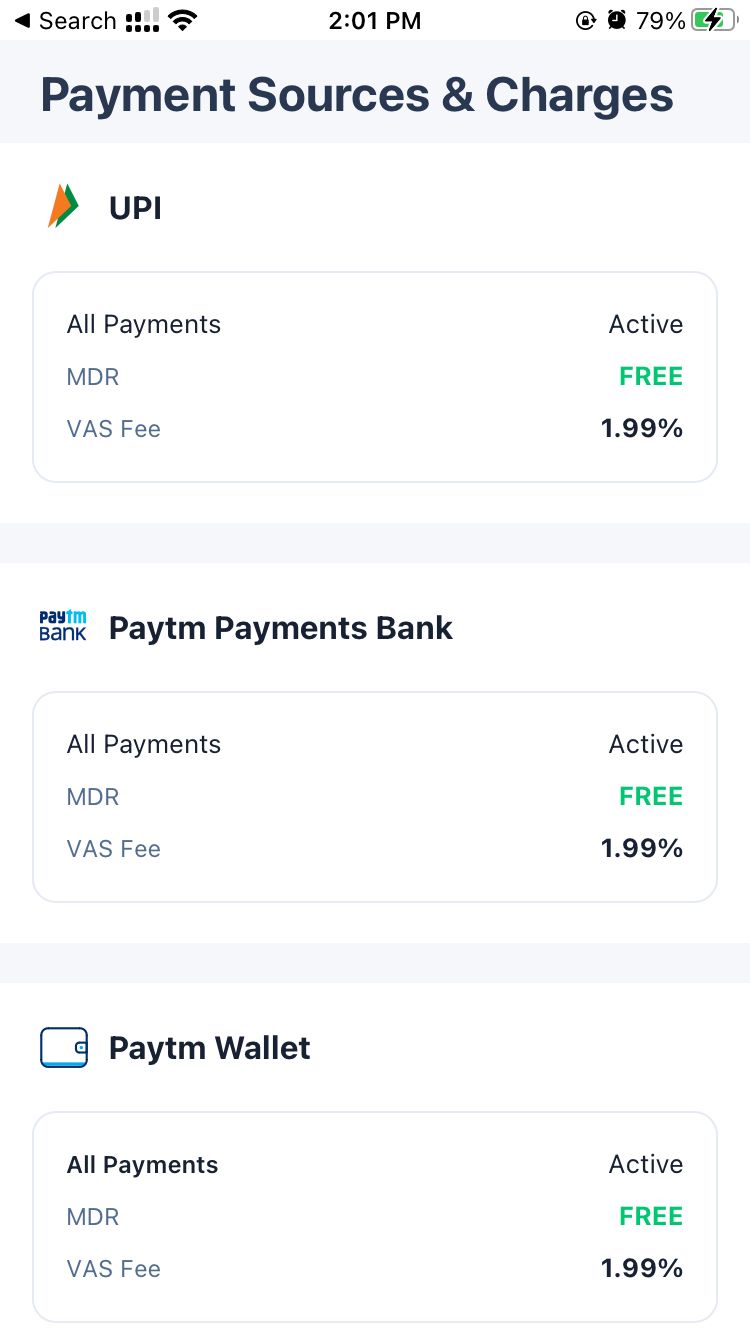

PayTM, one of India's most popular digital wallet and e-commerce payment system, has recently started charging a 1.99% value-added services (VAS) fee for all Unified Payments Interface (UPI) transactions made through its platform. This new fee, is not informed to merchants and is beeing unilaterally beeing charged. PayTM is not calling it MDR because as per regulations UPI cannot have MDR fees, so they are calling is VAS fee!

The Unified Payments Interface (UPI) is a real-time payment system developed by the National Payments Corporation of India (NPCI) that facilitates inter-bank transactions by instantly transferring funds between two bank accounts on a mobile platform. It was launched in 2016 and has since become one of the most popular methods of digital payments in India, with over 1 billion transactions being processed every month.

PayTM, which was launched in 2010, was one of the first digital wallet companies in India and has since grown to become one of the largest e-commerce payment systems in the country, with over 300 million users. The company has always positioned itself as a low-cost alternative to traditional banking, and it's this positioning that has made it so popular among consumers.

The decision to start charging a 1.99% VAS fee for UPI transactions has been met with a lot of criticism from PayTM merchants. Many believe that the fee is unjustified, as it is not charged by other digital wallet companies or even by traditional banks. Some have even gone so far as to say that the fee is a "cash grab" by the company, as it seeks to increase its revenue streams.

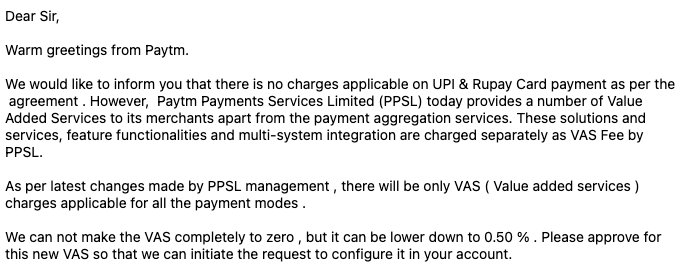

When merchants raise a complaint about the fees to PayTM, the support team is offering to reduce it to 0.5% as per the screenshot of the communication:

They are cleverly saying no charges as per agreement but going round the bush and say that they charge VAS charges. This is beeing charged even for the QR code scan payments and not just for the online payment gateway.

The move has led to a lot of speculation about the impact it will have on PayTM's user base. Some have suggested that the fee will deter merchants from using the platform for UPI transactions, potentially leading to a decline in the number of transactions processed through the platform. One thing that is certain is that the introduction of the VAS fee will have an impact on PayTM's revenue streams. The company is likely to see an increase in revenue as a result of the charge, which could help to offset any potential decline in the number of transactions processed through the platform.

As the company has not yet released the exact details projected revenues, it's hard to say how much revenue they could generate from this. However, some experts estimate that the company could generate an additional $50 million in revenue per year from the VAS fee alone.

In conclusion, PayTM's decision to start charging a 1.99% VAS fee for UPI transactions has caused a lot of controversy among its merchants and industry experts. The company will have to be very careful in how they implement and communicate this fee to their merchants, as they risk losing a lot of their user base if they don't do it right. Only time will tell how this move will affect the company's revenue streams and user