The Reserve Bank of India (RBI) has recently imposed a monetary penalty of ₹5.39 Crore (Rupees Five Crore and Thirty-Nine Lakh only) on Paytm Payments Bank Limited, in a move that underscores the central bank's commitment to enforcing financial regulations. The penalty was levied due to non-compliance with various provisions of the 'Reserve Bank of India (Know Your Customer (KYC)) Directions, 2016,' 'RBI Guidelines for Licensing of Payments Banks,' and additional guidelines pertaining to 'Enhancement of maximum balance at end of the day,' 'Cybersecurity framework in banks,' 'Guidelines on reporting of unusual cybersecurity incidents,' and 'Securing mobile banking applications including UPI ecosystem.' This article delves into the details of this monetary penalty, the background of the issue, and the implications it holds for Paytm Payments Bank Limited.

The Monetary Penalty

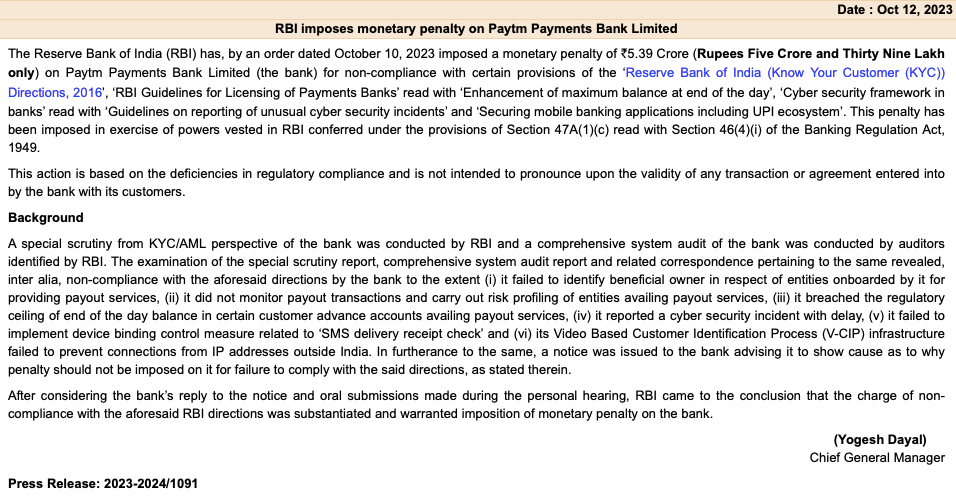

The Reserve Bank of India, acting under the authority vested in it by Section 47A(1)(c) read with Section 46(4)(i) of the Banking Regulation Act, 1949, imposed a monetary penalty of ₹5.39 Crore on Paytm Payments Bank Limited. This monetary penalty was imposed as a result of the bank's non-compliance with various regulations and guidelines related to Know Your Customer (KYC) procedures, cybersecurity measures, and the licensing of payments banks. It's essential to note that the penalty was not intended to question the validity of any specific transactions or agreements entered into by the bank with its customers. Instead, it was aimed at addressing deficiencies in the bank's regulatory compliance.

Background and Regulatory Scrutiny

The regulatory scrutiny leading up to this penalty was initiated by the RBI due to concerns regarding KYC and Anti-Money Laundering (AML) procedures at Paytm Payments Bank Limited. As part of this scrutiny, a special examination was conducted from the KYC/AML perspective, and a comprehensive system audit of the bank was carried out by auditors designated by the RBI.

The examination of the special scrutiny report, comprehensive system audit report, and related correspondence revealed a series of non-compliance issues by the bank. These issues included:

- Failure to Identify Beneficial Owners: The bank did not adequately identify the beneficial owners of entities onboarded by it for providing payout services. This omission is significant as identifying beneficial owners is a crucial component of AML procedures.

- Lack of Payout Transaction Monitoring: Paytm Payments Bank did not adequately monitor payout transactions, nor did it perform risk profiling of the entities availing payout services. Effective transaction monitoring is essential for identifying and mitigating potential risks, including those related to money laundering.

- Breaching Regulatory Ceiling: The bank exceeded the regulatory ceiling of the end-of-the-day balance in certain customer advance accounts that were availing payout services. Such breaches can create systemic risks and may affect the financial stability of the institution.

- Delayed Reporting of Cybersecurity Incident: The bank reported a cybersecurity incident with a delay. Timely reporting of such incidents is crucial for preventing further damage and safeguarding customer data.

- Failure to Implement Security Measures: Paytm Payments Bank failed to implement device binding control measures related to 'SMS delivery receipt check.' Ensuring the security of customer data is fundamental, and lapses in this area can lead to data breaches and cyberattacks.

- Issues with V-CIP Infrastructure: The bank's Video-Based Customer Identification Process (V-CIP) infrastructure failed to prevent connections from IP addresses outside India. This lapse in security may expose customer data to unauthorized access.

Enforcement Action

In response to the findings of the regulatory scrutiny and audit reports, the RBI issued a notice to Paytm Payments Bank Limited. The notice instructed the bank to show cause as to why a penalty should not be imposed for its failure to comply with the aforementioned RBI guidelines and directions.

The bank responded to the notice and presented its case during a personal hearing. After considering the bank's reply and oral submissions, the RBI came to the conclusion that the charges of non-compliance with the specified directions were substantiated and warranted the imposition of a monetary penalty on the bank.

Implications and Significance

The imposition of a monetary penalty on Paytm Payments Bank Limited carries several important implications and highlights significant aspects of regulatory compliance and cybersecurity in the Indian banking sector:

- Regulatory Vigilance: This enforcement action by the RBI underscores the regulatory body's commitment to ensuring that banks and financial institutions adhere to established guidelines and directions. The penalties serve as a deterrent to institutions that might be tempted to overlook or bypass regulatory compliance.

- KYC and AML Compliance: KYC and AML procedures are fundamental to financial institutions' efforts to combat money laundering, fraud, and other illicit activities. The penalty on Paytm Payments Bank for failing to identify beneficial owners and properly monitor payout transactions highlights the RBI's expectations regarding the robustness of these processes.

- Cybersecurity Prioritization: The delay in reporting a cybersecurity incident and the failure to implement essential security measures demonstrate the increasing importance of cybersecurity in the financial sector. The RBI's insistence on timely reporting and implementing security controls is a testament to the evolving threat landscape in the digital banking domain.

- Customer Data Protection: The failure to prevent connections from IP addresses outside India highlights the need for robust cybersecurity measures, particularly in the context of personal and financial data protection. Customer data breaches can result in significant financial and reputational damage to institutions.

- Regulatory Transparency: The process leading up to the monetary penalty, including the notice to the bank and the opportunity for the bank to present its case during a personal hearing, underscores the importance of transparency in regulatory enforcement. It allows institutions to address concerns and clarify their position before penalties are imposed.

- Preventing Systemic Risks: The regulatory ceiling on end-of-the-day balances in customer advance accounts is designed to prevent systemic risks and maintain financial stability. Breaches of this kind can have far-reaching consequences and are closely monitored by regulatory authorities.

Conclusion

The RBI's decision to impose a ₹5.39 Crore monetary penalty on Paytm Payments Bank Limited serves as a stark reminder to all financial institutions in India that regulatory compliance, robust cybersecurity measures, and the protection of customer data are paramount. This enforcement action highlights the RBI's dedication to maintaining the integrity of the financial sector and ensuring that banks adhere to established guidelines and directions.

Paytm Payments Bank's case demonstrates the importance of thorough KYC and AML procedures, timely reporting of cybersecurity incidents, and the implementation of security controls. It also underscores the significance of maintaining regulatory transparency and addressing compliance concerns promptly.

As the financial sector continues to evolve in the digital age, it is imperative that all banks and financial institutions prioritize regulatory compliance and cybersecurity to protect their customers and maintain the trust of the public. The RBI's enforcement actions are a key instrument in achieving this goal and ensuring the overall stability and integrity of the Indian banking industry.