Whisky-backed crypto token to hit the market soon according to a report by cointelegraph. Wave Financial will be handling the process of tokenizing Wilderness Trail Distillery’s trademark Bourbon. According to the report, the process of conversion to blockchain makes it cheaper and more transparent for companies to attract investors.

Wave Financial offers early-stage investment, asset management and treasury management to further the growth of the crypto and digital asset ecosystem.

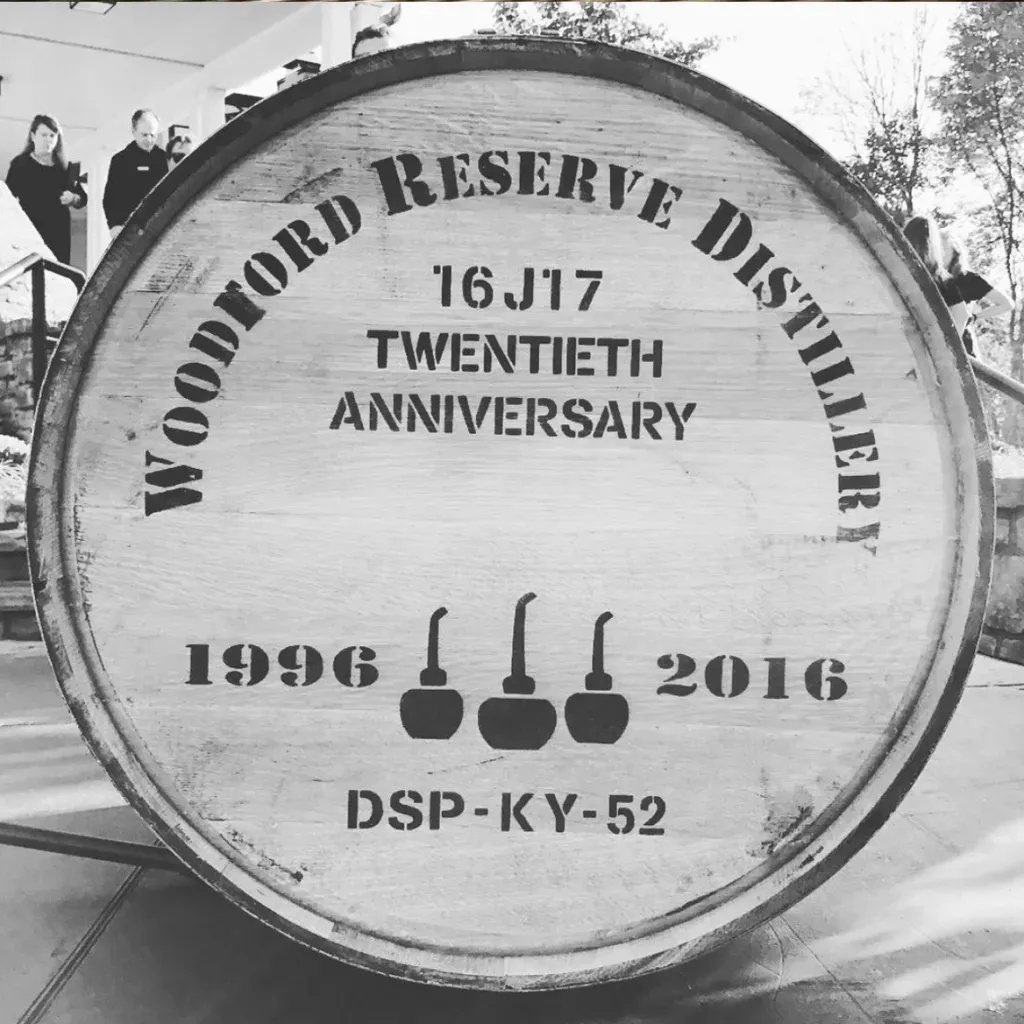

Established in 1785, Bourbon County is one of Kentucky’s oldest counties. As an early hub of the whiskey trade, farmers shipped whiskey in oak barrels stamped from Bourbon County down the Ohio and Mississippi Rivers, all the way to New Orleans. The long trip aged the whiskey, while the oak wood lent it a distinct mellow flavor and amber color. As whiskey from Bourbon County grew in popularity, the liquor became known simply as “Bourbon”.

In 1964, Congress officially recognized Bourbon’s place in America’s history, and its future, by declaring it a distinctive product of the United States. Or, as we like to say, “America’s Official Native Spirit.” Today, Kentuckians continue the time-honored tradition of distilling Bourbon, perfecting the craft their ancestors developed centuries ago.

United States-based Wave Financial Group will manage the tokenization of up to $20 million worth of bourbon whiskey produced by Kentucky-based Wilderness Trail Distillery. Whisky-backed crypto token to hit the market soon

Wave told Cointelegraph in an email sent on March 18 that the firm will tokenize between 10,000 and 20,000 barrels of liquor so it can be offered through a specialized digital asset fund. The “Wave Kentucky Whiskey 2020 Digital Fund” will allow investors to purchase tokens linked to the inventory of whiskey barreled this year, which is estimated to represent up to four million bottles of bourbon.

According to Waves, the tokenization grants investors exposure to the spirit’s value appreciation and a share of the proceeds from its sale expected for three years after the distillation. The selected bourbon could reportedly increase its value from $1,000 per barrel at distillation to $4,000 five years later.

Wave is also in discussion with security token exchanges to allow for secondary market trading of the bourbon-backed tokens. A firm’s spokesperson told Cointelegraph that the blockchain that will host the tokens has yet to be determined, but given the involvement of Tezos-partnered (XTZ) development company Vertalo, Tezos seems likely.

The advantages of tokenization

A Wave spokesperson told Cointelegraph that the advantage of blockchain-based tokenization of such a fund is that it makes it cheaper for investors to access exposure to the asset and provide liquidity to the secondary market. The firm’s president and fund manager Benjamin Tsai pointed out that the approach made investing in the spirit much more accessible:

“The [fund] provides investors a rare opportunity to access this unique asset class traditionally unavailable due to high upfront costs and purchase minimums, low liquidity, scarcity of production capacity, and technical know-how.”

The representative also explained that the firm applies traditional investment management techniques to digital assets offering funds allowing investors cryptocurrency exposure.