Instamojo, a key player in India's digital payment and e-commerce sphere, has issued a pressing call to its extensive merchant network, requesting them to update and resubmit their KYC (Know Your Customer) documents. This email notification has sent ripples through the community, indicating a possible compliance predicament within the company. Previously were wrote about KYC drives from American Express, BharatPe and this is the third report we are writing in the recent times. Intriguingly with Instamojo, even those who have undergone KYC verification less than two months ago are now being asked to revisit the process.

The Compliance Challenge:

Merchants with prior KYC clearance are likely to be perplexed by this unusual turn of events. While KYC is a standard procedure, the insistence on re-verification so soon after the initial check raises questions about the evolving regulatory landscape and its impact on Instamojo's compliance efforts.

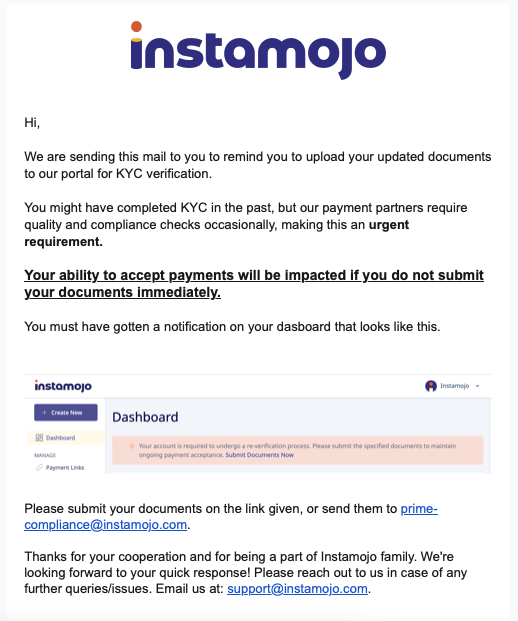

The company's email notification underscores the criticality of compliance for fintech entities, implying that even recently verified accounts must conform to the latest regulatory standards. This move is not only unusual but has significant consequences, as it could disrupt a merchant's ability to transact through the Instamojo platform.

Urgency Amidst Regulatory Uncertainty:

It is evident from the notification that Instamojo's payment partners have pressed for an urgent re-evaluation of their merchants' KYC documentation. This insistence on swift compliance points to a certain level of pressure the company may be facing from its partners and regulatory authorities.

In the ever-evolving fintech landscape, adhering to compliance and quality standards is paramount, and fintech companies need to remain agile to meet these evolving requirements. The sudden urgency indicates that Instamojo may be grappling with compliance challenges that require immediate attention.

Notification and Submission Process:

To initiate the re-verification process, merchants should check their Instamojo dashboard, where they would have received a notification closely resembling the email's content. This notification serves as a stark reminder to submit updated KYC documentation.

The email notification also provides a direct link for document submission. Alternatively, merchants can opt to send their documents to prime-compliance@instamojo.com. The company is making every effort to ensure the process is straightforward, considering the urgency of the matter.

Challenges in the Fintech Landscape:

Compliance is a formidable concern in the fintech sector. Not only does it guarantee secure and transparent transactions, but it also safeguards consumers and the industry itself. Regulatory authorities like the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) maintain a vigilant eye on fintech companies, ensuring they adhere to established standards and protect the interests of all stakeholders.

Instamojo's sudden emphasis on re-verification highlights the complexity and rapid evolution of regulatory requirements within the digital payment and e-commerce sector. To remain competitive, fintech companies must remain vigilant and adaptable to changes in the regulatory landscape.

Implications for Merchants:

For Instamojo merchants, the request for re-verification presents an unexpected challenge. Even those who completed KYC within the past two months are not exempt. Failure to adhere to this directive could have severe consequences, including disruptions in the ability to accept payments and conduct business operations through the platform.

Merchants should acknowledge that this request is not arbitrary; rather, it reflects Instamojo's commitment to maintaining the highest standards of quality and compliance. While it may introduce temporary inconvenience, it ultimately works toward creating a more secure and reliable environment for financial transactions.

Conclusion:

Instamojo's recent email notification signals a critical phase in the journey of fintech compliance. Merchants are urged to act promptly and complete their KYC re-verification to ensure uninterrupted access to payment processing services. As the regulatory landscape continually evolves, companies like Instamojo are working diligently to meet its dynamic demands, securing their role as trusted and secure facilitators of digital commerce in India.

In conclusion, the call for KYC re-verification by Instamojo reflects the regulatory uncertainties and compliance challenges fintech companies are facing. This situation has introduced an element of urgency into the compliance process, affecting even recently cleared accounts, highlighting the need for agility and responsiveness within the fintech industry.